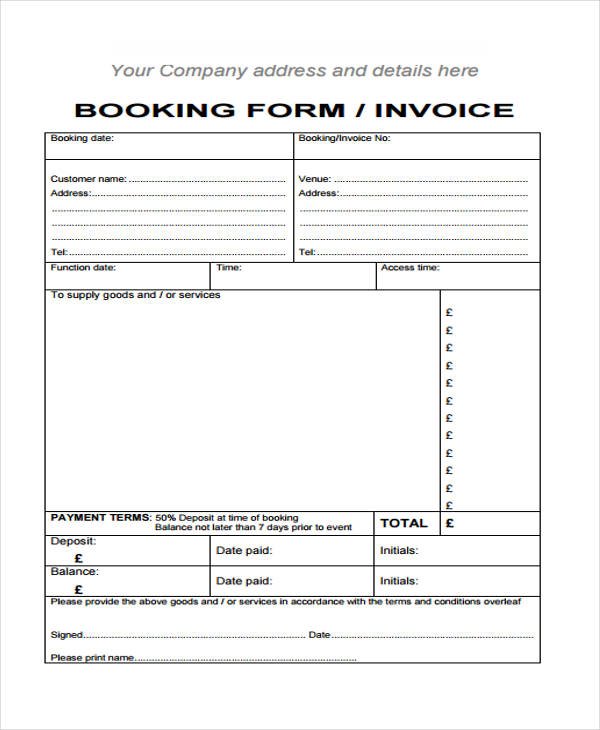

The second option answers the question, what is a deposit invoice? Using this option, you would issue out two invoices to your client - the first one for $1,000 to confirm their order, then another one for $4,000 when you deliver your products or services. As such, this first option is best suited for transactions where the period between invoicing and payment is extremely short. When they report sales tax, they would have based it on the full invoiced amount of $5,000, even before the completion of the project and payment of the balance due. Most businesses report sales tax on an accrual basis. Your business would, therefore, issue a $1,000 receipt when the down payment is made and another for $4,000 upon completion of the project, when the invoice is paid in full. The description column would, however, indicate that a $1,000 deposit is required for the project to start or for a product to be dispatched.

Using our example, the total amount would be $5,000. When a client places an order, a business can prepare a single invoice for the full amount owed. In such a case, you can handle the invoice in one of two ways: Option 1: Single Invoice For example, if the total value of your goods or services is $5,000, you can request a $1,000 down payment. The rest of the payment would, therefore, be due at specific milestones or upon delivery of the goods or services in question. Sometimes businesses may require new customers to make a down payment before they commence a project or deliver a product. As such, invoices are invaluable tools, not only for keeping track of payments and amounts owed but also for calculating tax obligations. If the products or services aren’t paid for on delivery, the invoice may also specify the agreed payment terms. A typical invoice records and itemizes a transaction between a buyer and a seller. While quotations and delivery notes are somewhat straightforward, invoices are an entirely different beast.

Depending on the type of business you run, you may regularly provide your customers with quotations, invoices, delivery notes, receipts, and other such documents.

0 kommentar(er)

0 kommentar(er)